The following error shows up for people..

The ':UserAgentTxt' element is invalid - The value 'Mozilla/5.0 (Windows NT 10.0; Win64; x64) AppleWebKit/537.36 (KHTML, like Gecko) Chrome/65.0.3325.181 Safari/537.36' is invalid according to its datatype 'String' - The Pattern constraint failed.

This issue has been identified and will be fixed in the next update for the Web/Online Version. The current fix is in "Q&A" testing. Soon as we get notification of the fix, we will post on here.

Monday, April 9, 2018

Tuesday, March 27, 2018

Google Chrome Update breaks Check Printing

Google Chrome had recently released an update within the last 2 weeks. This new update now prevents downloading checks through the use of their web browser. Firefox utilizes the same drivers that Google Chrome uses, so its affected as well.

Unfortunately, you will have to use either Internet Explorer (Light blue E with a Golden Ring), or Microsoft Edge (Dark blue E on all Windows 10 computers)

Unfortunately, you will have to use either Internet Explorer (Light blue E with a Golden Ring), or Microsoft Edge (Dark blue E on all Windows 10 computers)

Attention Internet Explorer Users:

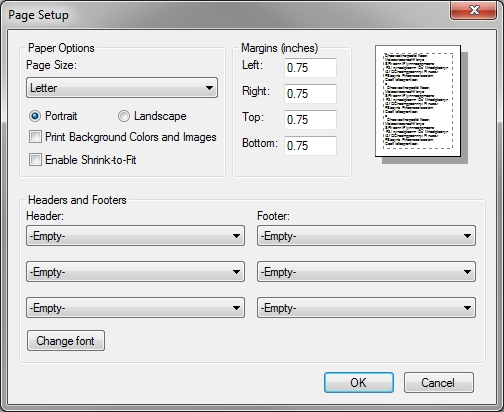

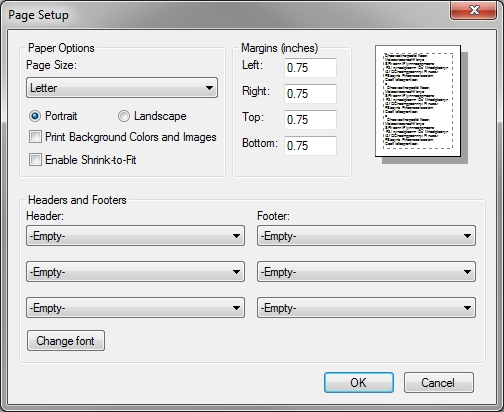

Internet Explorer uses headers and footers when printing by default. Internet Explorer will not allow disabling automatically by the Online Check Printing application. You must disable these when printing checks or checks will not print correctly for cashing. To disable printing of headers and footers follow the instructions below:

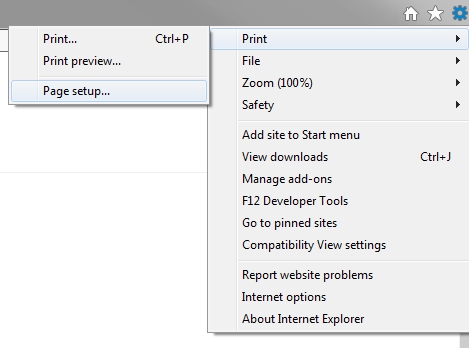

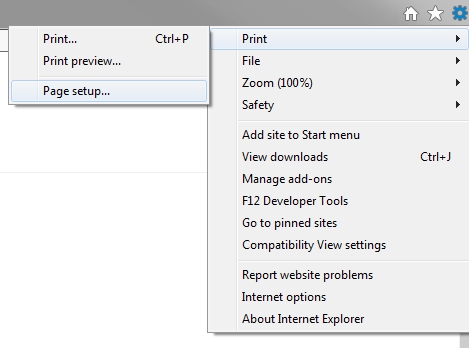

- Press the Tools button. Under the Print Menu, click Page Setup.

- Make sure the settings are the same as shown below and click OK.

Wednesday, February 28, 2018

IRS Reject R0000-904-03 "Software ID in the Return Header must have passed testing for the form family and 'TaxYr'

This issue only affects the Installation Tax Software

To fix this reject, just go ahead and reinstall the 1040 Module update and this will fix the issue. To do this simply follow these instructions in the Installation Tax Software itself

- Log into any username in the Tax Software

- Go to Tools > Utility/Setup Assistant

- On the Utility Window, go to Tools > Uninstall Modules

- Find and select US Individual 1040 and then hit [OK] at the bottom

- Next, simply go to Communications > Get Module Updates

That's it! You should be all set now.

You can also just download the latest 1040 update by logging into http://support.taxwise.com or by clicking this link here (1040 Version 6) to download the current 1040 version for when this post was created.

Monday, February 5, 2018

Routing Number Rejects with the IRS

We have been receiving reports on e-filing rejects. The 1040 e-file is rejected with the following message:

RejectCode: R0000-906-02 Routing Transit Number (RTN) included in the return must be present in the e-File database.

This is an issue that the IRS is working to resolve. Once they have a resolution, you will need to re-send the return.

We will post updates as we receive them.

Thursday, January 25, 2018

Installing the correct TeamViewer for support

Always make sure to use our version of TeamViewer! If you call in and have the wrong version of TeamViewer we can't assist you! We have sent out several emails about this in the past. Please please please make sure you have the correct version of TeamViewer!! If you are above version 8, we can't help you!

Best way to make sure you are using the correct version is to simply UNINSTALL any version of TeamViewer you currently have, and then follow these specific instructions!

If you are still confused, we have created a video as well

Best way to make sure you are using the correct version is to simply UNINSTALL any version of TeamViewer you currently have, and then follow these specific instructions!

- Step #1 - ON STEP 4 BELOW You will see the RED BUTTON asking you to RIGHT CLICK and go to Save Target AS. This example is using Google Chrome, however, FireFox and Internet Explorer should have similar menu item asking to Save As, Save Link As, or Save Target As

- Step #2 - Next, you will see this popup asking where to save. You will need to click DESKTOP like it shows HIGHLIGHTED in the image below, and then type SureFire TeamViewer in the box and hit [Save] when finished

- Step #3 - You will now have an icon that looks like this on your desktop somewhere, you can just run this file now

- Step #4 - Now take everything you learned from the above steps and put it into action!!!

Sure-Fire TeamViewer Screen Share

Please RIGHT Click here and go to Save Target As/Save Link As and save this to your desktop.

Please RIGHT Click here and go to Save Target As/Save Link As and save this to your desktop.

If you are still confused, we have created a video as well

Saturday, January 20, 2018

Goverment Shutdown and Bank Acknowledgement delays

We are now in a government shutdown until further notice and we have gotten a lot of emails asking how does this affect everyone. The E-filing center is still operational and still running, the only main downside people will notice is IRS phoneline has reduced its staff by 80% (except 6 - 8 hour hold times) and also expect some longer than expected delays on getting acknowledgments during this testing phase. Staff members overlooking issues with EFIN's or office information as well are affected by this which also pushes further on being able to process any types of returns.

With that being said, I want to remind everyone that we are in a "eFiling test phase". I expressed this in a few posts ago when we talked about the "roll out" period or the "test phase" that started on the 17th. Many of you are concerned because of acknowledgments being delayed or other items. Again, please understand this is a "testing" phase. There can, and usually are every year, some issues in some way shape or form. On top of all this, the government shutdown has significantly hindered a lot of items.

Waiting for that watermark to be removed so you can paper file? The government shutdown means this will take longer because of no one at IRS available to approve the forms.

Customers are calling in concerned about the returns not showing up at the bank. As every year we remind people that technically unless it's been longer than 72 hours, we don't consider this an issue ESPECIALLY during a "testing" phase like right now. Those that I have talked about this past week are starting to see those acknowledgments at the bank level.

If you are ever concerned there are few items you need to double check before treating it as a serious issue.

With that being said, I want to remind everyone that we are in a "eFiling test phase". I expressed this in a few posts ago when we talked about the "roll out" period or the "test phase" that started on the 17th. Many of you are concerned because of acknowledgments being delayed or other items. Again, please understand this is a "testing" phase. There can, and usually are every year, some issues in some way shape or form. On top of all this, the government shutdown has significantly hindered a lot of items.

Waiting for that watermark to be removed so you can paper file? The government shutdown means this will take longer because of no one at IRS available to approve the forms.

Bank product acknowledgment issues

Customers are calling in concerned about the returns not showing up at the bank. As every year we remind people that technically unless it's been longer than 72 hours, we don't consider this an issue ESPECIALLY during a "testing" phase like right now. Those that I have talked about this past week are starting to see those acknowledgments at the bank level.

If you are ever concerned there are few items you need to double check before treating it as a serious issue.

- Make sure on the tax return itself you marked it as a bank product, and the bank forms have a blue/green check mark next to them

- If you are still in doubt, look it up on the Return Query

- Install Version you can also open the return and go under Tools > Return Status to see details if you aren't feeling like these are 100% correct and want to double check you can look them up and see what the Electronic Filing Center shows by looking them up on the Return Query system by logging into http://support.taxwise.com If you want a full detail walkthrough on how to do this, simply log into our website at http://surefiretaxsoftware.com and go under our Knowledgebase and do a search for: return query

- Web Version Users simply click on where it says "Sent" in the return list, look up the SSN. On the Blue Return Query screen, you can find specific information detailing what the latest information is

No matter which option you do for either Install or Web Version you will see this type of information listed...

As you can see it was marked as a bank product and was sent off and this is all that matters. Even if you don't see information on the right-hand side, it's perfectly fine!!! Just got to give it a bit of time.

Tuesday, January 16, 2018

Republic loans, filing starting on 17th, and Government Shutdown threats

While I wish I had excellent news today, we are in an industry "scare" right now. The global scale of a potential pending Government Shutdown has a huge effect on us right now for good, and really bad.

If you haven't been paying attention to the news, this Friday is the deadline for the government to figure out what's going on with a ton of different items. While they have already extended government spending 3 times, an extension this time around seems more unlikely because of Democrats wanting to find a permanent solution to a number of items including DACA

What does this mean for us you may ask? Well, quite simply if the government shuts down, then so does eFiling. I can't stress the nightmare this would cause everyone so let us all keep fingers crossed. Also, anyone applying for a new EFIN since December 22nd, 2017 hasn't been approved yet, even if you been in the tax industry over past 5 years. This means any applications for EFIN's are still on hold at the IRS level and they haven't issued out any new ones yet. We are all still waiting for EFINs to be released as an industry.

Long story short, let us continue to pray for them to figure this out by Friday because until they do no new EFIN(s) are being issued.

We are highly recommending everyone to hold off any PreACK loans or anything until tomorrow the 17th. The reason because starting tomorrow all eFiles for the Loans will be processed normally and you will also get IRS acceptances as well. This means that they can be processed through the Online Version. If you are someone who started the process for a 2nd EFIN when we made public we would offer you software for free, make sure to contact us by phone so we can go over your options for filing your remaining returns on Web Version.

If you haven't been paying attention to the news, this Friday is the deadline for the government to figure out what's going on with a ton of different items. While they have already extended government spending 3 times, an extension this time around seems more unlikely because of Democrats wanting to find a permanent solution to a number of items including DACA

What does this mean for us you may ask? Well, quite simply if the government shuts down, then so does eFiling. I can't stress the nightmare this would cause everyone so let us all keep fingers crossed. Also, anyone applying for a new EFIN since December 22nd, 2017 hasn't been approved yet, even if you been in the tax industry over past 5 years. This means any applications for EFIN's are still on hold at the IRS level and they haven't issued out any new ones yet. We are all still waiting for EFINs to be released as an industry.

Long story short, let us continue to pray for them to figure this out by Friday because until they do no new EFIN(s) are being issued.

January 17th eFiling and today hold-offs

As we said last week the January 17th you can start processing returns and sending them off to the IRS. Please keep in mind that not all returns you send will get an acceptance! You want to get as many as you can ready to be sent in first thing tomorrow morning around 7am EST.

Days for receiving acceptance/rejects on returns are the following:

Jan 17th, 18th... 19th - 22nd are "pause dates" and then starts back on 23th of January. During these times the "5-day rule" doesn't apply. If you are familiar with the "5-day rule" this rule means no one will consider an acknowledgment being late unless it been more than 5 business days. (Week doesn't count as business day(s)).

Jan 17th, 18th... 19th - 22nd are "pause dates" and then starts back on 23th of January. During these times the "5-day rule" doesn't apply. If you are familiar with the "5-day rule" this rule means no one will consider an acknowledgment being late unless it been more than 5 business days. (Week doesn't count as business day(s)).

Republic PreACK loans are now regular loan starting Jan 17th

We are highly recommending everyone to hold off any PreACK loans or anything until tomorrow the 17th. The reason because starting tomorrow all eFiles for the Loans will be processed normally and you will also get IRS acceptances as well. This means that they can be processed through the Online Version. If you are someone who started the process for a 2nd EFIN when we made public we would offer you software for free, make sure to contact us by phone so we can go over your options for filing your remaining returns on Web Version.

If you haven't submitted any returns through the Install Version yet and wanted to be under Web Version, just let us know and we will switch you back to Web Version today.

Sunday, January 14, 2018

Reminder of our office hours

This is a reminder we will be closed on Monday, January 16th 2018. We are always closed on federal holidays every year. Feel free to create a ticket on your account, or try to send an email and we will respond to you first chance we get.

Wednesday, January 10, 2018

How to select States for Install Version

*Note - If you have Web Version of Tax Software you don't need to do anything, all states are automatically applied to your account!*

I wanted to post a video completely showing from start to finish how to add States to your package. Once you add the states, it will apply for all eFile tax years (for example 2015, 2016, and 2017). This video will go over everything from start to finish and is only around 10 minutes long. This is extremely beneficial and will be absolutely needed also for doing a Rehang later on, or doing an EFC Return Lookup like you are used to doing in the past.

Here is the video and full explanation here, if you want a text only version, you can log into http://surefiretaxsoftware.com and go under Knowledgebase and do a search for: add states

As always on videos just hit the full-screen button, or view directly on YouTube. Direct link is: https://www.youtube.com/watch?v=NeHo48Y2KKc

Monday, January 8, 2018

Printing Returns for the PreACK Loan

Right now absolutely no forms are available for printing OTHER than the Republic Bank application for the Loan. You can see the forms availability in the post below this one talking about Form Availability.

When you go to Print Return for the PreACK you want to make sure to just check the box for "Signature Forms" like this

You will see this error message, you need to ignore it and continue forward because federal forms aren't available for print yet

When it prints out, or doing a print preview you will see something like this for the US 1040 Pg1 because again, its not available for printing yet.

However, you can see the Republic Bank application will print out like normal.

*NOTE - You must get a in-person signature for these pages!!! StayPaperless will not allow you to do a request for signature for these pages until Federal Forms have been approved for printing!*

When you go to Print Return for the PreACK you want to make sure to just check the box for "Signature Forms" like this

You will see this error message, you need to ignore it and continue forward because federal forms aren't available for print yet

When it prints out, or doing a print preview you will see something like this for the US 1040 Pg1 because again, its not available for printing yet.

However, you can see the Republic Bank application will print out like normal.

*NOTE - You must get a in-person signature for these pages!!! StayPaperless will not allow you to do a request for signature for these pages until Federal Forms have been approved for printing!*

Information on Form Printing and Federal/State Updates will be available

I wanted to start a new post about this information since it technically was included in the "Republic" information and, of course, if you aren't doing Republic Bank applications you wouldn't of reading it.

Here is the information you are all looking for.

We encourage you to monitor the E-File Availability list at https://support.taxwise.com/support/JurisdictionStatus.aspx along with the Forms Release Schedule at https://support.taxwise.com/support/FormDevelopmentStatus.aspx for the latest information. The next software product updates are scheduled for early January and will enable e-file capabilities.

Here is the information you are all looking for.

We encourage you to monitor the E-File Availability list at https://support.taxwise.com/support/JurisdictionStatus.aspx along with the Forms Release Schedule at https://support.taxwise.com/support/FormDevelopmentStatus.aspx for the latest information. The next software product updates are scheduled for early January and will enable e-file capabilities.

For example, here are the information from the above sites for the Federal Forms

| Jurisdiction | Module Estimated Release | E-file Status | E-file Estimated Release |

|---|---|---|---|

| EPS Bank | 1/10/2018 | Not Supported | |

| Federal 5500 | 2/27/2018 | Planned | 2/27/2018 |

| Federal Corporation | 1/10/2018 | Approved | 1/10/2018 |

| Federal Estate | 5/15/2018 | Not Supported | |

| Federal Exempt | 1/17/2018 | Approved | 2/22/2018 |

| Federal Fiduciary | 1/17/2018 | Testing | 2/1/2018 |

| Federal Gift | 2/27/2018 | Not Supported | |

| Federal Individual | 1/10/2018 | Approved | 1/10/2018 |

| Federal Miscellaneous | 1/17/2018 | Not Supported | |

| Federal Organizer | 5/15/2018 | Not Supported | |

| Federal Partnership | 1/10/2018 | Approved | 1/10/2018 |

| Federal SCorporation | 1/10/2018 | Approved | 1/10/2018 |

Saturday, January 6, 2018

How to get a Republic RBIN Number

In order to get a Republic RBIN number that is required to put on all tax returns you, and any one else in your office that will be preparing returns, will need to do the Compliance Training through Republics Training website.

To access their Training website simply go to: http://www.republicrefund.com/training

To access their Training website simply go to: http://www.republicrefund.com/training

*Note - When asked for Tax Software Provider make sure to mark for TaxWise*

Installation Software Basic Walkthrough

This new video will go over a quick walkthrough on installing the Installation version of our software. This will also go over key items to make sure you have everything you need to start processing the PreACK loans through Republic Bank.

Subscribe to:

Comments (Atom)