Remember to always do Communications > Get Program Updates and also Communications > Get Module Updates daily to ensure you are up-to-date!

If nothing downloads the first time, here are some key updates you can download now to get the process started.

Federal Updates

| 1040 Individual 1.0 (12/31/2021) |  |

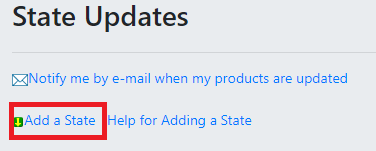

State Updates

| 3Fund 1.0 (1/1/2022) |  |

|

| Fee Collect 1.0 (1/1/2022) |  |

|

| Refund Advantage 1.0 (1/4/2022) |  |

|

| Republic 1.0 (12/31/2021) |  |

|

| Santa Barbara 1.0 (1/1/2022) |  |

|