- Log in to the TaxWise Solution Center, https://support.taxwise.com

- If you don't know your login information,

login to https://surefiretaxsoftware.com and locate your Client ID

and simply use the Forgot Password feature on

the https://support.taxwise.com login screen to have it

emailed to you *Make sure to check junk mail*

- If you don't know your login information,

- Once logged in simply click on return query to go to the next page.

- Enter the SSN or EIN of the return and click Search. (Tax Year will default to the current tax year.)

On this same screen, you can do REHANG of acknowledgements once you have looked them up.

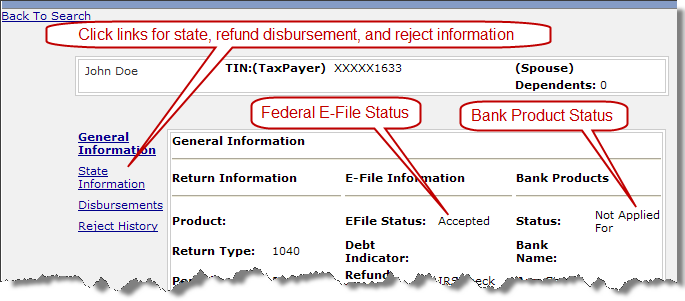

- The first screen displays General Information, including federal e-file and bank product status. Click the other links for information on the state e-file(s), refund disbursement and reject codes.

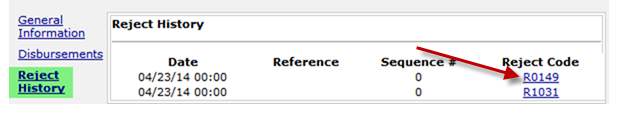

- When you click Reject History, you will see a list of all rejects for this return. Double-click the most recent reject.

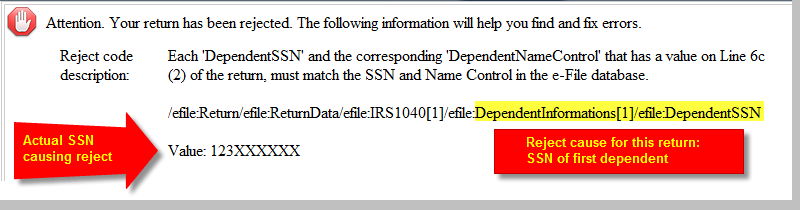

- Click the Reject Code link to see the explanation for the reject and the actual value in the return that is causing the reject.

- In the example below, the reject is caused by the SSN of the first dependent listed in the return. The SSN does not match what the IRS has on file.